The Future of EVs in India: Growth, Challenges and Opportunities

The Future of EVs in India: Growth, Challenges and Opportunities

Published On Feb 27, 2025 07:20:35 PMIntroduction:

The electric vehicle (EV) revolution is gaining momentum in India, driven by rising fuel prices, environmental concerns, and government incentives. As the world moves towards sustainable mobility, India is striving to position itself as a global EV hub. The transition from internal combustion engine (ICE) vehicles to EVs is not just a necessity but an opportunity for economic growth, job creation, and technological advancement. With ambitious targets and a growing interest in clean transportation, the Indian EV sector is poised for significant transformation.

The Current EV Landscape in India

EV adoption in India is steadily increasing, with electric two-wheelers leading the charge. According to reports, EV sales in India crossed 1.5 million units in 2023, a significant jump from previous years. The penetration of EVs remains relatively low compared to traditional vehicles, but the momentum is unmistakable.

Key players driving India's EV market include:

-

Tata Motors: Dominating the electric four-wheeler segment with models like the Tata Nexon EV and Tiago EV.

-

Ola Electric: Revolutionizing the two-wheeler segment with the Ola S1 series.

-

Ather Energy, TVS, and Bajaj: Competing fiercely in the electric scooter space.

-

MG Motor and Hyundai: Expanding the premium EV car market.

-

Startup Ecosystem: Emerging companies like Pravaig Dynamics and Simple Energy are innovating in the EV space.

Government Policies and Incentives

To accelerate EV adoption, the Indian government has implemented several policies and incentives:

-

FAME II (Faster Adoption and Manufacturing of Electric Vehicles): This scheme provides subsidies to reduce the cost of EVs, particularly for two-wheelers, three-wheelers, and commercial vehicles. The total outlay for FAME II is ₹10,000 crore, aiming to support the sale of 1 million electric two-wheelers, 500,000 electric three-wheelers, 55,000 electric four-wheelers, and 7,000 electric buses.

-

State EV Policies: Many states, including Maharashtra, Delhi, Karnataka, and Tamil Nadu, offer additional subsidies, road tax waivers, and incentives for setting up charging stations.

-

Charging Infrastructure Development: The government plans to set up 46,000 EV charging stations across the country to reduce range anxiety among consumers.

-

Production-Linked Incentive (PLI) Scheme: Aimed at encouraging local manufacturing of EV components and batteries, this scheme provides incentives worth ₹18,100 crore.

-

Green Number Plates and Zero Registration Fees: The government is offering regulatory benefits like green license plates and zero registration fees for EVs to promote adoption.

Key Challenges Hindering EV Growth

Despite the progress, several challenges remain:

-

Charging Infrastructure: India lacks a widespread network of charging stations, particularly in tier-2 and tier-3 cities. Currently, India has around 8,700 public charging stations, whereas countries like China have over 1 million.

-

High Initial Costs: EVs are still expensive compared to ICE vehicles due to high battery costs. A Tata Nexon EV costs around ₹15-17 lakh, whereas its petrol counterpart costs significantly less.

-

Battery Technology & Recycling: India heavily depends on imported lithium-ion cells, mainly from China, increasing production costs. Additionally, EV battery disposal and recycling remain a concern, with limited infrastructure to handle e-waste.

-

Consumer Awareness & Mindset: Many consumers hesitate to switch to EVs due to concerns about range, charging time, and resale value.

Opportunities and the Road Ahead

The future of EVs in India is promising, with several opportunities for growth:

-

Expansion of Charging Infrastructure: IThe Indian government, along with private players like Tata Power and Reliance, is investing in a robust charging network. Plans to integrate EV charging stations with petrol pumps and build battery-swapping stations are in motion.

-

Local Battery Manufacturing: India is actively investing in lithium-ion battery manufacturing to reduce costs and reliance on imports. Companies like Reliance New Energy and Ola Electric are setting up gigafactories.

-

Growth in Electric Two-Wheelers and Three-Wheelers: With lower costs and high urban demand, these segments will lead India's EV transition. Over 80% of India's EV market is dominated by two- and three-wheelers.

-

Integration with Renewable Energy: Solar-powered charging stations and green energy solutions can make EVs even more sustainable. Companies are exploring Vehicle-to-Grid (V2G) technology,where EVs can store excess energy and supply it back to the grid.

-

Battery Swapping Solutions: Companies like Sun Mobility and Gogoro are developing battery-swapping networks, reducing downtime for EV users and eliminating long charging wait times.

India’s Global Standing in EV Adoption

Compared to global EV leaders like China, the US, and Europe, India is still in the early stages of EV adoption. However, India has unique advantages:

-

Growing Domestic Market: India is the world’s third-largest automobile market, presenting vast opportunities for EV penetration.

-

Affordability and Mass Production: India has the potential to become a global EV manufacturing hub, focusing on cost-effective models for emerging markets.

-

Learning from Global Leaders: By adapting best practices from China’s charging infrastructure expansion and Norway’s aggressive EV policies, India can accelerate its transition.

Conclusion

India’s EV journey is at a critical juncture. While challenges persist, the opportunities far outweigh them. Public-private collaborations, continuous policy support, and advancements in battery technology will be key drivers in accelerating EV adoption. With the right strategies and investments, India can achieve its vision of a cleaner, more sustainable transportation future. By 2030, the Indian government aims for EVs to make up 30% of total vehicle sales. The question remains: Can India achieve 100% EV adoption in the coming decades? The journey has begun, and the road ahead looks electrifying.

Popular Articles:

45k+ Views

45k+ Views

Tata Nexon

The Tata Nexon is one of India's most popular compact SUVs, known for its bold design etc...

45k+ Views

45k+ Views

Maruti Suzuki Grand Vitara

The Maruti Suzuki Grand Vitara is a game-changer in the mid-size SUV segment, etc...

45k+ Views

45k+ Views

Mercedes-Benz G-Class

The Mercedes-Benz G-Class, also known as the G-Wagon, is an iconic SUV etc...

45k+ Views

45k+ Views

Tata Punch

The Tata Punch has revolutionized the compact SUV segment in India, offering a perfect mix of affordability etc...

Popular Articles:

India is Pushing EV Adoption

India is the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme.

The EV Battery Recycling Problem

As India accelerates its transition to electric vehicles (EVs), a major challenge looms—battery

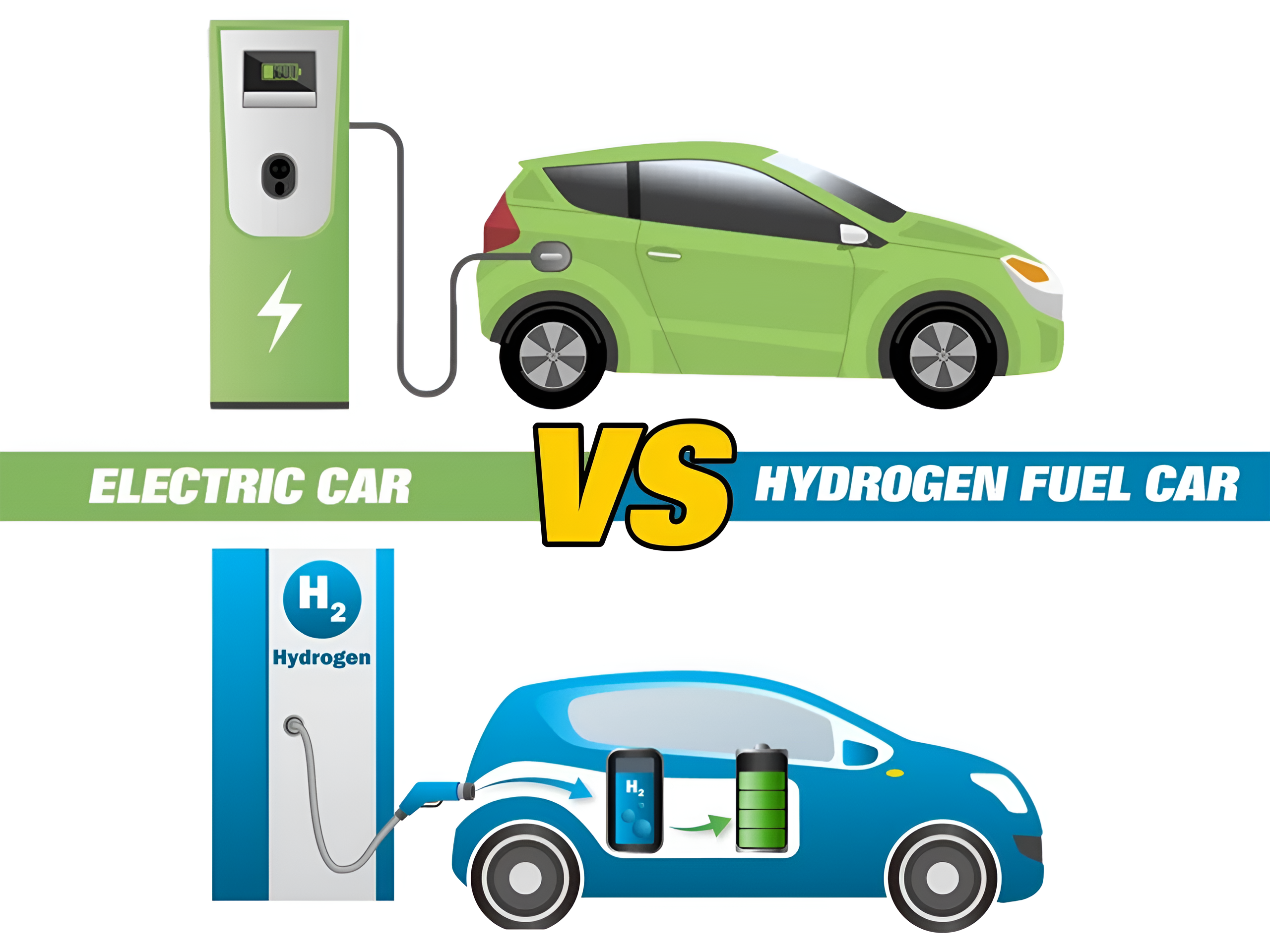

Hydrogen vs Electric

India is at a crucial juncture in its transition to sustainable transportation.

The Future of EV Batteries

Electric Vehicles (EVs) are at the forefront of the global transition to clean mobility